For day traders navigating through volatile markets, using the Relative Strength Index (RSI) is crucial for finding the best entry points. RSI helps traders spot when prices are stretched too far in either direction, detect patterns where price movements diverge from RSI readings, and recognize shifts in bullish or bearish momentum. These insights provide valuable clues about market sentiment and potential changes in trends.

Incorporating RSI into intraday trading strategies allows traders to optimize their entry points, manage risks more effectively, and take advantage of short-term price changes with accuracy and timeliness.

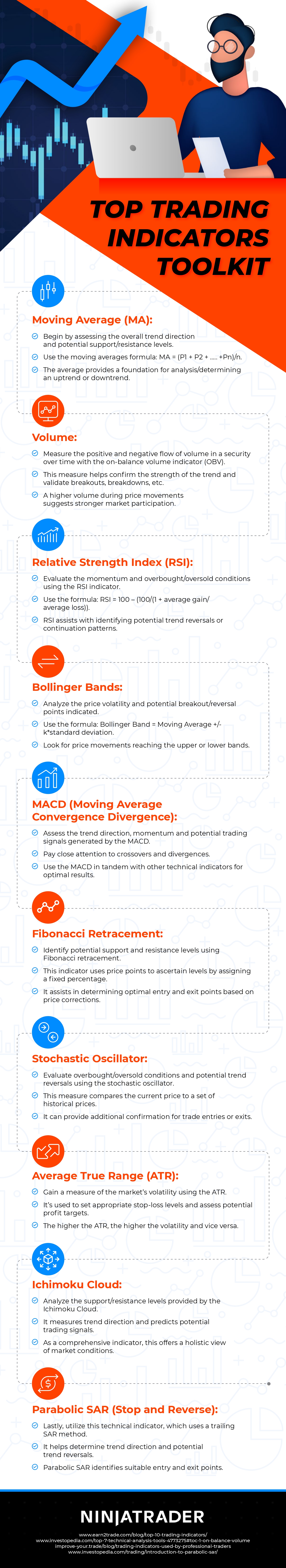

Hoping to delve deeper into this indicator and others? For more information on the indicators influencing the success of day traders, take a moment to review the infographic coupled alongside this post.

Top Trading Indicators Toolkit, provided by NinjaTrader, an organization helping you learn what is futures trading